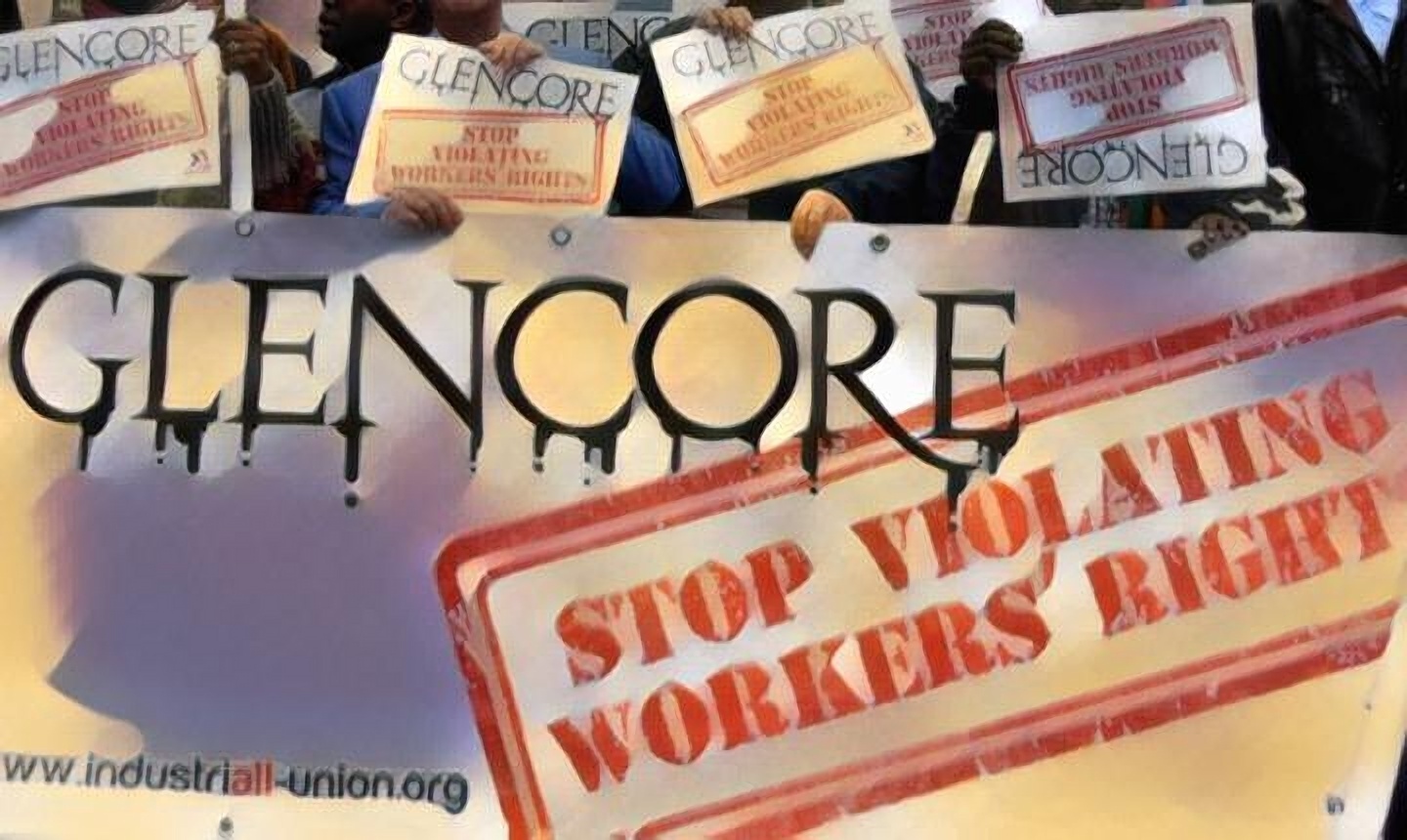

8 May, 2024Last week, IndustriALL co-hosted, along with the Global Unions’ Committee on Workers’ Capital (CWC), Fair Finance International and Oxfam, a webinar entitled “Below the Surface: Governance Risks and ESG Issues at Glencore”. Aimed at Glencore shareholders, the well-attended event allowed investors to hear directly from those affected by the company’s operations. With Glencore’s annual general meeting coming up in less than a month, the webinar laid out multiple issues for investors to raise in their engagement with the company.

Taking the floor were climate experts, trade union and civil society representatives and investors themselves, who discussed concerns arising from how Glencore manages its operations. These included allegations of poor working conditions, refusal to enter into social dialogue with unions, irresponsible exit from mining assets, environmental contamination of local communities and opaque and misleading climate reporting.

As speakers’ accounts made clear, serious gaps exist between what the company says publicly and what happens on the ground. The audience learned that problems are not limited to one or two operations but show patterns of poor management across the company. Another thread emerging from the discussion was the risk associated with the company’s approach to environmental, social and governance (ESG) issues: financial, operational, and reputational risks as well as the risk of lawsuits. This raises major questions about governance and oversight and whether the board of directors is competent to manage these challenges.

“We want open and transparent dialogue with Glencore on the closure of mines and on a just transition, which the company refuses to do.”

Claudia Blanco, SINTRACARBON

“You speak, and tomorrow you’re no longer an employee because you’ve been dismissed. This is what the union wants to resolve with the company.”

NUMSA

“How many more studies are needed to accept that the contamination comes from the mine? Glencore must act responsibly, stop denying, stop polluting and remedy the affected people.”

Paul Maquet, CooperAcción (Peru)

Investor speakers urged Glencore shareholders to engage with affected stakeholders such as trade unions and NGOs as part of their own due diligence, and to challenge board directors to do the same. Shareholders were also encouraged to vote against directors to demonstrate their dissatisfaction with the company and to collaborate with other investors to increase their leverage.

Says IndustriALL mining director Glen Mpufane:

“The ultimate aim of IndustriALL and its allies is to make Glencore improve its practices and reduce human rights violations and environmental harm associated with its operations. The company’s poor performance in these areas and its repeated failure to respond to its many stakeholders raise red flags that cannot be ignored.”